21/08/2025

The residential mortgage market is reaching a saturation point, and many brokers are now broadening their services by stepping into commercial and asset finance. As demand in the home loan sector remains high and competition intensifies, diversification is becoming an attractive pathway for growth.

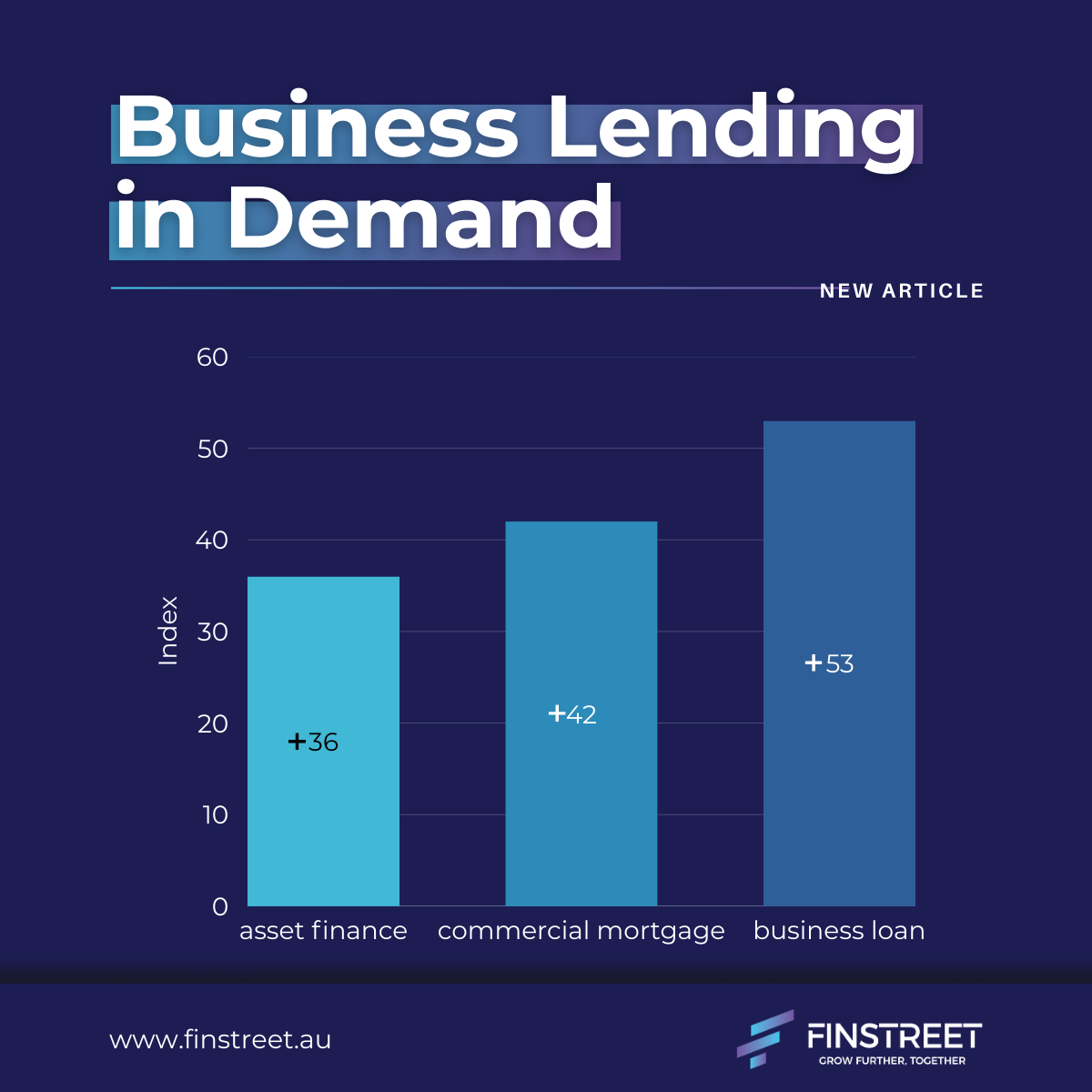

Industry data shows this shift is gathering momentum. Research from Agile Market Intelligence found that 37% of brokers arranged commercial mortgages in the year to April 2025, with another 28% planning to do so in the next 12 months. Business lending is also gaining traction, with 26% of brokers active in this space and nearly a quarter intending to follow suit soon. The Mortgage and Finance Association of Australia has also confirmed that the total value of commercial loans handled by brokers has climbed to record levels.

Why Brokers Are Branching Out

For brokers, the move into commercial finance is not just about chasing larger deals. It is also about creating a more complete service offering. By covering both residential and business needs, brokers can build deeper client relationships and reduce the risk of losing customers to competitors who can provide a broader range of solutions.

For example, a client may start with a home loan but later require finance for equipment, trade, or working capital. Brokers who can manage both sides of their client’s financial life are well placed to capture repeat business while strengthening loyalty.

Challenges of a New Market

Transitioning into commercial lending, however, is not without its hurdles. Unlike residential, which is often more straightforward, commercial deals require a strong grasp of financial statements, industry-specific knowledge, and patience to manage long transaction timelines. Some deals can take months, even a year, to close.

These challenges have led many brokers to remain firmly in the residential space. Yet the relative shortage of professionals who can work seamlessly across both areas is opening the door for those willing to invest in the skills needed. Brokers who master both residential and commercial lending are positioning themselves in a niche that has significant long-term value.

Bigger Deals, Bigger Rewards

The commercial market not only provides brokers with a way to diversify but also offers the potential for higher earnings. Larger loan sizes and greater bargaining power with banks mean brokers can deliver strong outcomes for clients while improving their own profitability. With lenders often competing aggressively for sizeable commercial deals, brokers have the ability to negotiate highly competitive terms.

A Market on the Move

As residential lending continues to dominate but becomes increasingly crowded, more brokers are expected to venture into commercial, business, and asset finance. Those who adapt quickly and build expertise in these areas are likely to benefit from stronger client retention, broader service offerings, and greater growth potential.

The shift signals an important evolution in the industry, from a focus primarily on home loans to a more balanced approach that meets both personal and business financing needs.

Our suite of commercial lending products is designed to give brokers the tools they need to compete in this growing space. From flexible commercial mortgages to tailored business and asset finance solutions, we make it easier for brokers to diversify their offering, strengthen client relationships, and capture new opportunities. With our support, brokers can confidently step into commercial lending and position themselves for sustainable growth in a competitive market.

Start here: https://finstreet.au/loan-products/commercial/